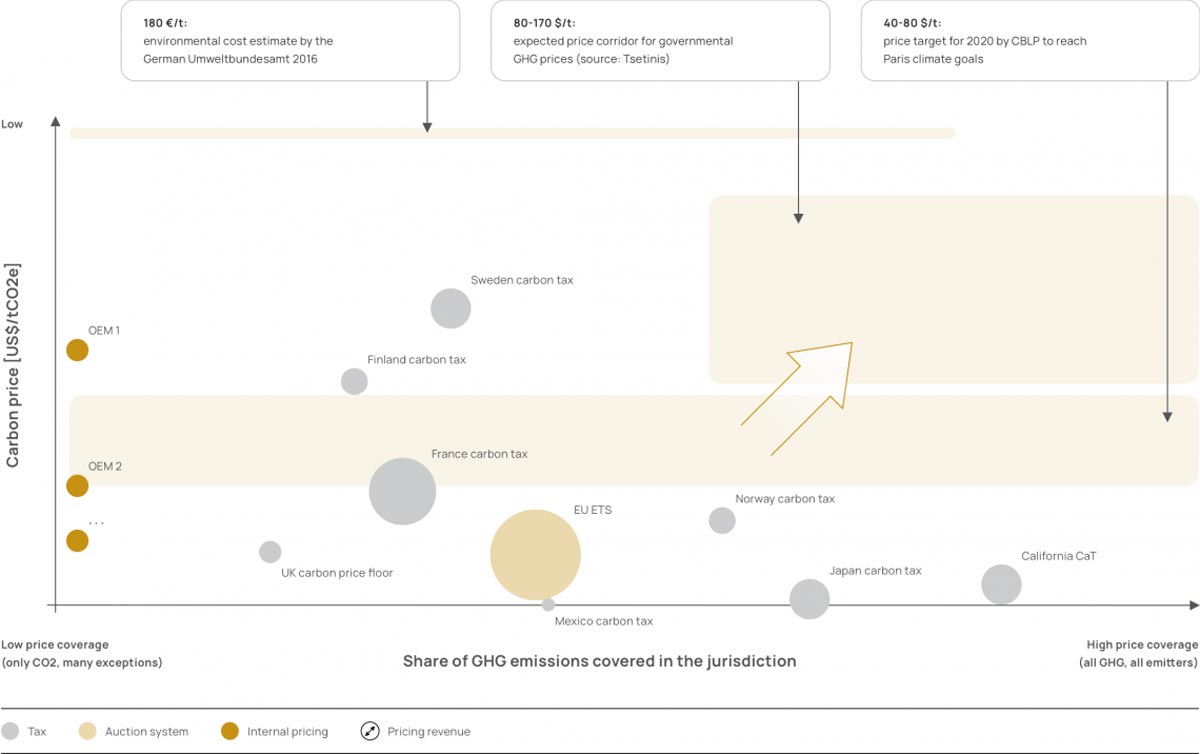

Given the current discussions on substantial changes of emission pricing, it is key to understand how this will impact automotive players globally

Many companies are flying blind

Companies are facing challenges when re-evaluating their portfolios. It is still hard to get relevant, accurate, and timely data due to the absence of standards, the vast number of different factors to be considered, a lack of appropriate tools, or missing granularity. As a result, companies are struggling to answer the question of what products to produce and where, and based on which supply chain.

How can carbon pricing be used to make emissions a business case?

To address this challenge, carbon pricing has been established as a system. It comes in the form of emissions trading systems, carbon taxes, and internal prices that must be fully understood throughout the entirety of production networks and supply chains. Two disciplines need to be closely integrated: the art of product costing and carbon footprint analysis. How to do it? Read more.

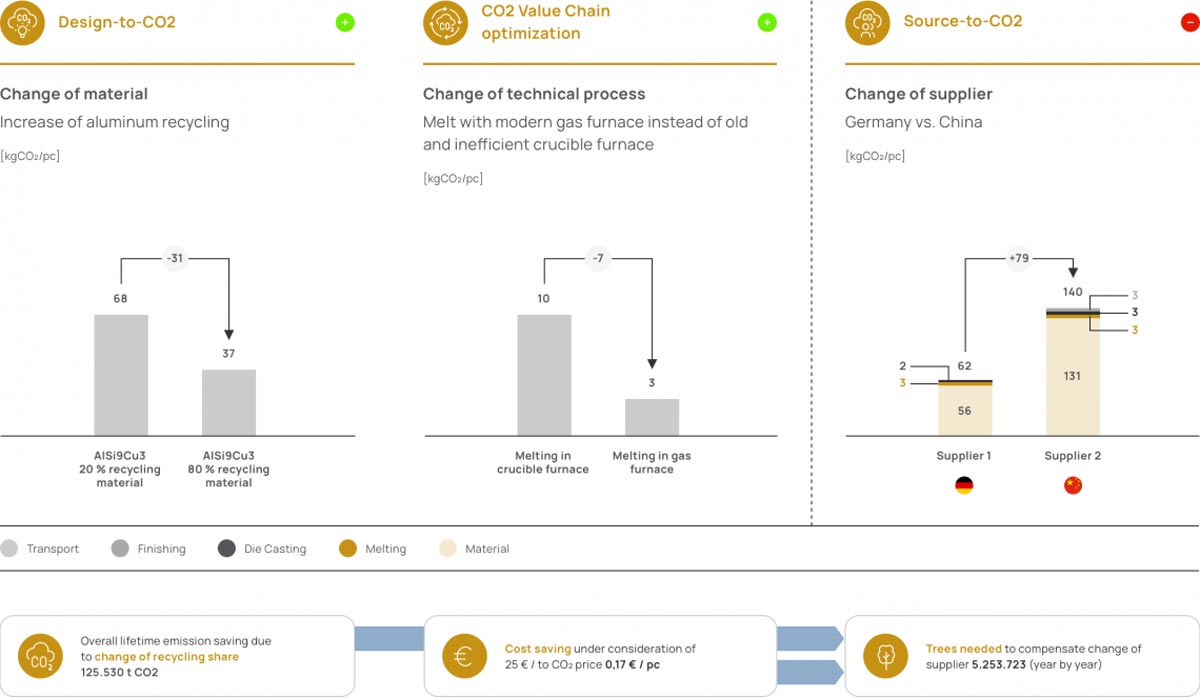

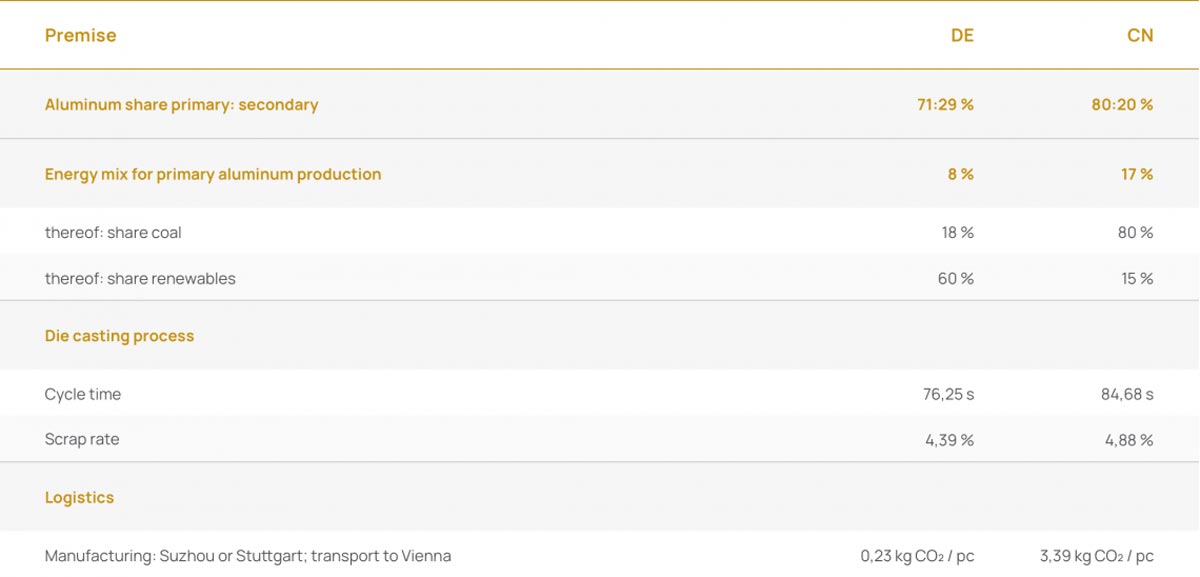

Example ‘aluminum die casting’

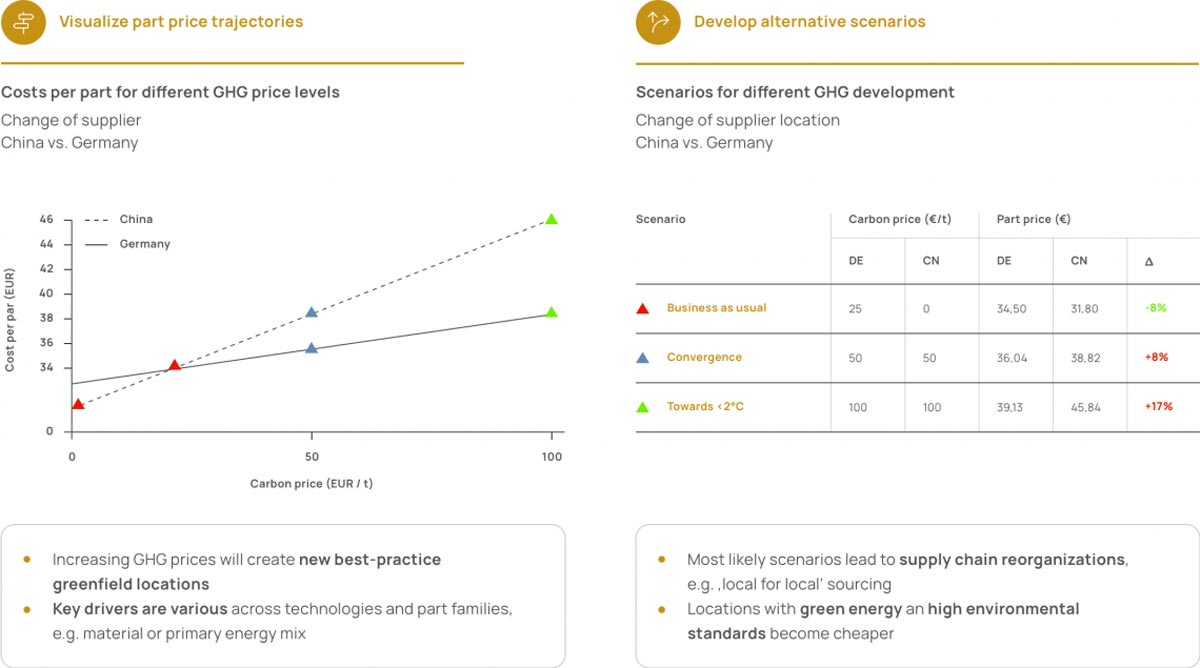

Changes in emission pricing will have severe impacts on global supply chains:

- The “Business as usual” scenario is comparable to the EU ETC being implemented, but no border tax. The result: production in China is cheaper.

- The “Convergence” scenario puts production in Germany ahead.

- The “Toward <2°C” scenario based on US$50–100/t CO₂ by 2030. The result: production in China is no longer competitive.

While some optimization ideas result in substantial emission reductions, others lead to a significant increase

This means that some ideas which could make sense commercially would disqualify under CO₂ aspects

As a result, changes in emission pricing will have severe impacts on global footprint strategies and supply chains

The impact of CO₂ pricing is massive — and it requires urgent action. Now — and on current and future portfolios.

The Reason? Simple: the impact of CO₂ pricing. It affects the entire value chain, i.e. everything from how we develop, where we buy, and where we produce. The consequences are straight forward: significant cost increases will result in the end of global supply chains.

Interested?