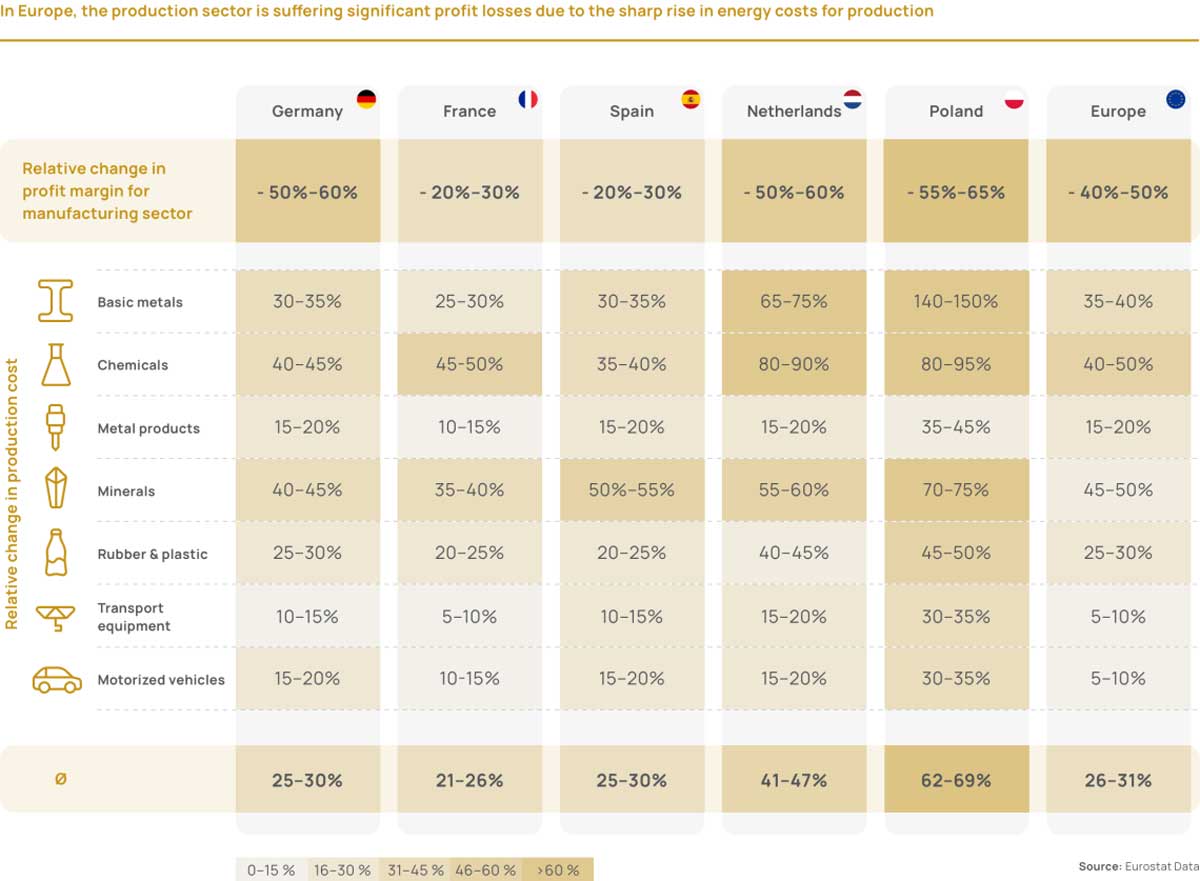

In Europe, the production sector is suffering significant profit losses due to the sharp rise in energy costs for production

The price increase effect in 2022 had a strong impact on the production costs of energy-intensive industries such as steel, chemicals, and minerals. The individual industries and countries were faced with a margin decline of up to 65%. In order to mitigate this effect, various measures and subsidy packages have already been initiated by the respective governments.

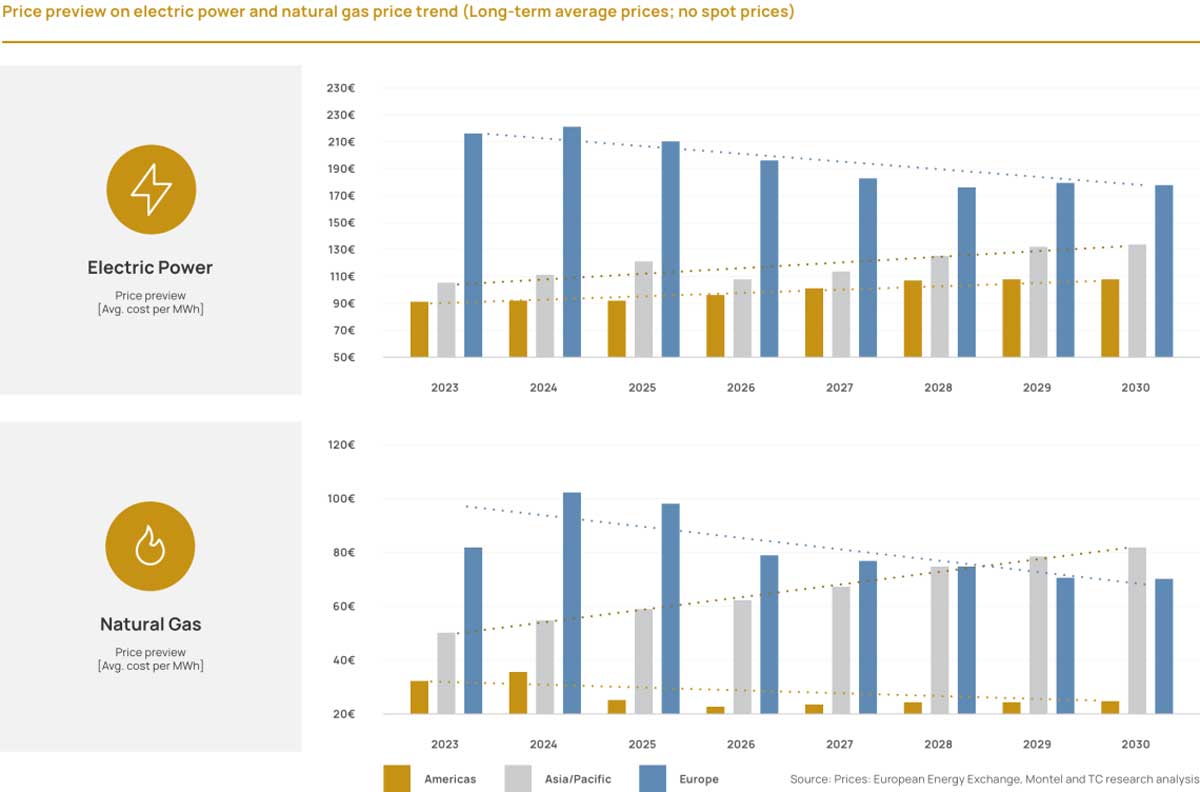

The long-term trend requires action for global positioned companies

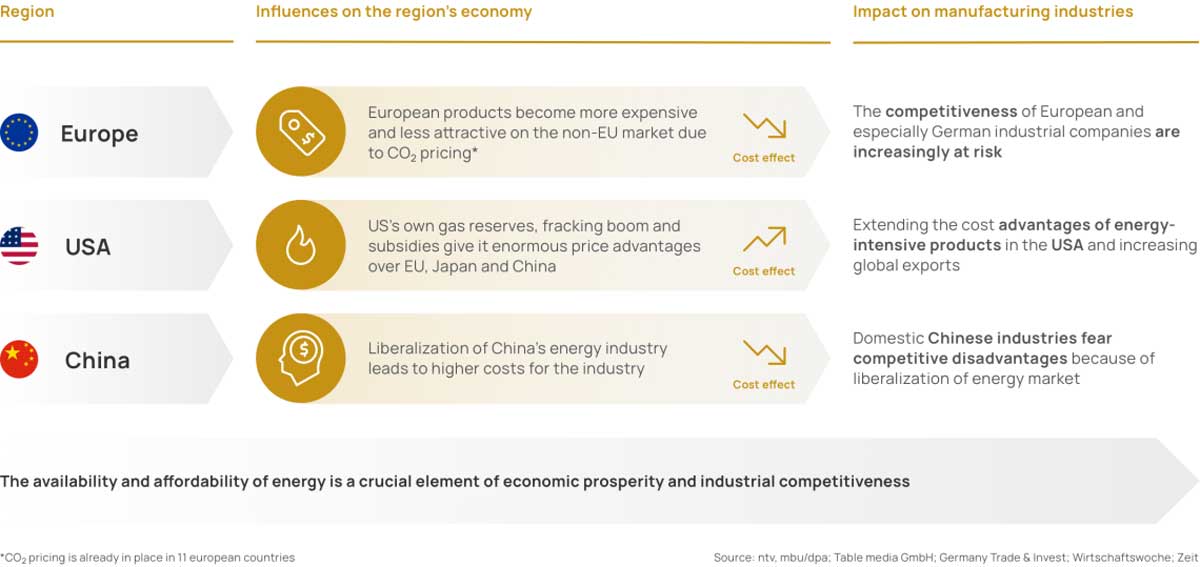

Forecast for 2028 in terms of Natural Gas, energy costs will vary significantly over the next few years with break-evens between Asia/Pacific and Europe. In the long term, Europe and China will converge to a high price level, whereas the Americas already offer price advantages and favorable conditions in the long term. For Europe, this implies reduced competitiveness.

Strategic adjustments can not only reduce the risk, but properly executed, achieve a competitive advantage

In order to answer the key question of how a company can produce and source profitably in the future, taking into account energy price developments and risks, we have designed four major field of investigations. The first step is to calculate the individual effect of the price shift for each company and to derive various scenarios. Based on the existing global production network, the second field of investigation involves not only risk reduction but also a complete rethink of the footprint, product allocation, and the inclusion of new evaluation criteria. We have developed individual roadmaps for our customers to set the strategic course for a successful future.