Supply chain and resilience impacts are totally unevaluated

A forward-looking assessment of economic viability is essential for investment and asset decisions. As our insights and project experiences show, this large market is lobby-driven and has lacked important directional decisions in technology for years. Essential ROI-driving parameters are still insufficiently determined. Supply chain and resilience risks are totally unevaluated and are thought likely to hit this industry hard and unexpectedly.

Missing directional technical decisions – TC is able to benchmark different systems – Example: Geared drive vs. Direct drive

How can risks be made tangible and predictable?

It is of immense importance for wind operators, investors, and suppliers to make profitability risks tangible and predictable. While cost optimization programs are now exhausted, focused gigantism increases the vulnerability of supply chains as well as resilience risks and it leads to significant cost increases due to current material price development. But how can risks and opportunities be balanced? How do supply chain risks impact ROI?

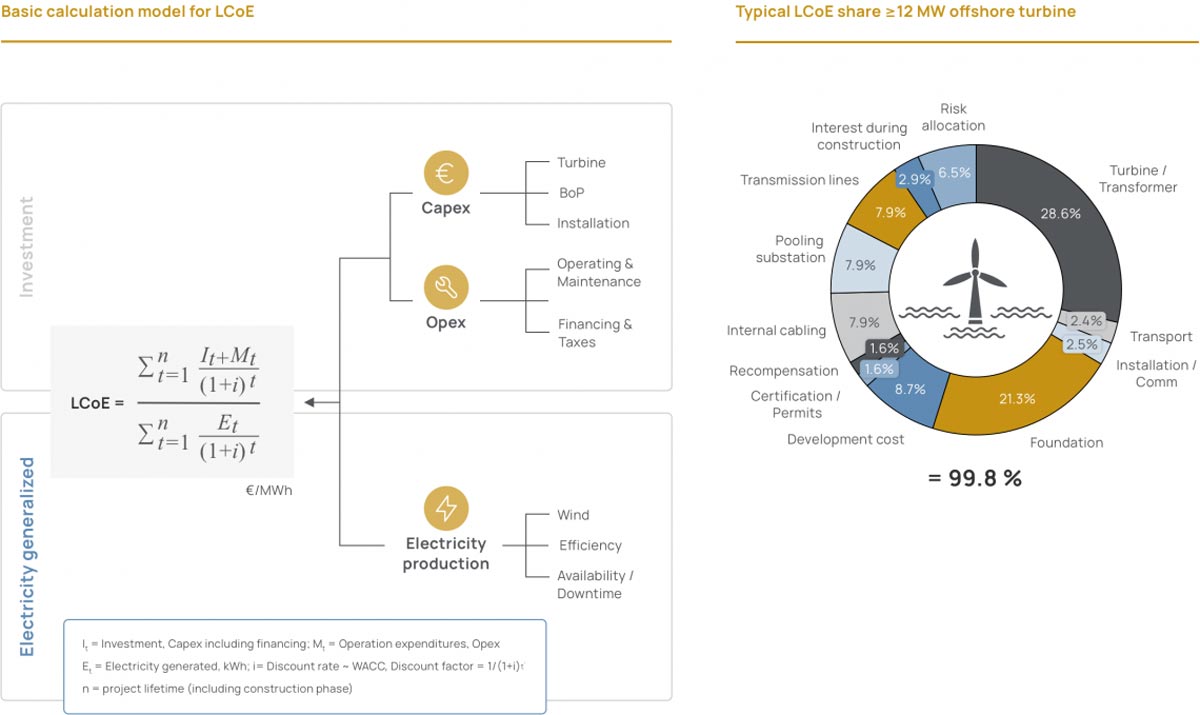

Sensitivity and simulation of levelized cost of energy is key to success

It is fundamental to understand the influencing parameters on the ROI of energy production, measured in LCoE. But this is only one part of the story and largely available. Knowing the sensitivity of ROI-driving parameters is crucial.

To make impacts predictable, detailed profitability simulations are essential to safeguarding the wind power industry of the future.

Our team understands LCoE and is able to identify cost drivers and optimization levers

To bring light into the darkness and to make resilience risks tangible, we have developed a LCoE-based simulation model, including details like turbine failure rates or finance interest rates – making impacts predictable.

Our fact-based model can offer competitive advantages for investors, operators, OEMs and suppliers to drive the wind power technology of the future.